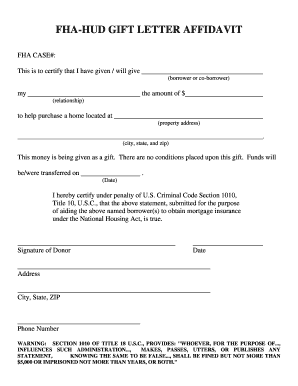

Canada MCAP Gift Letter 2001-2026 free printable template

Show details

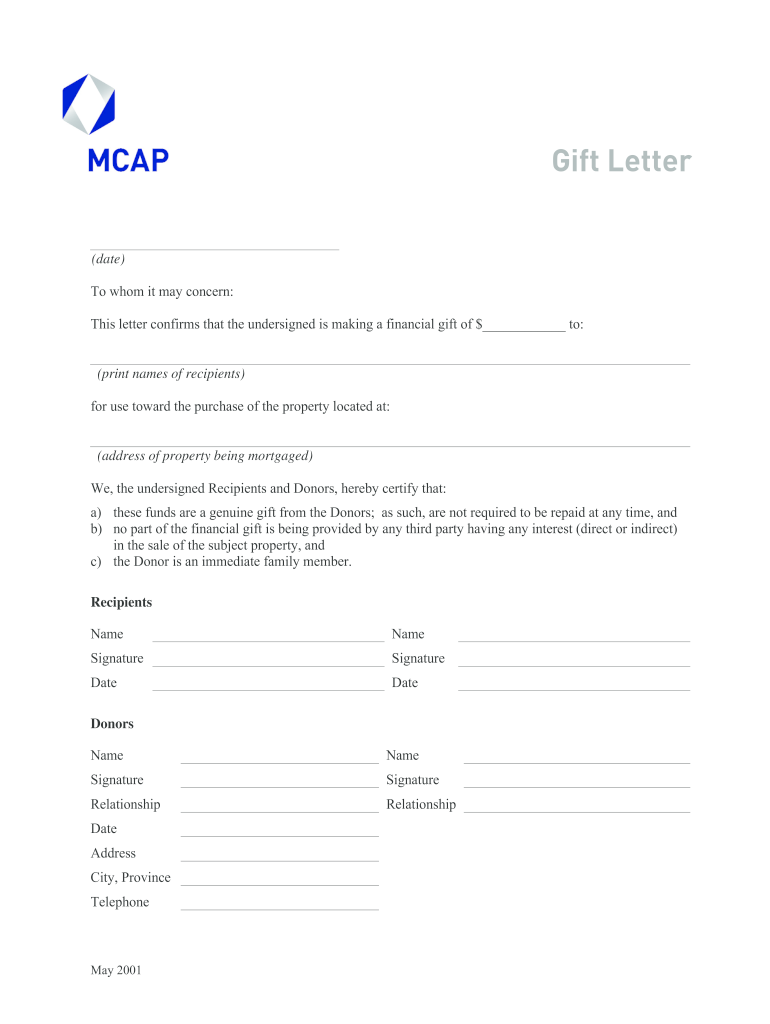

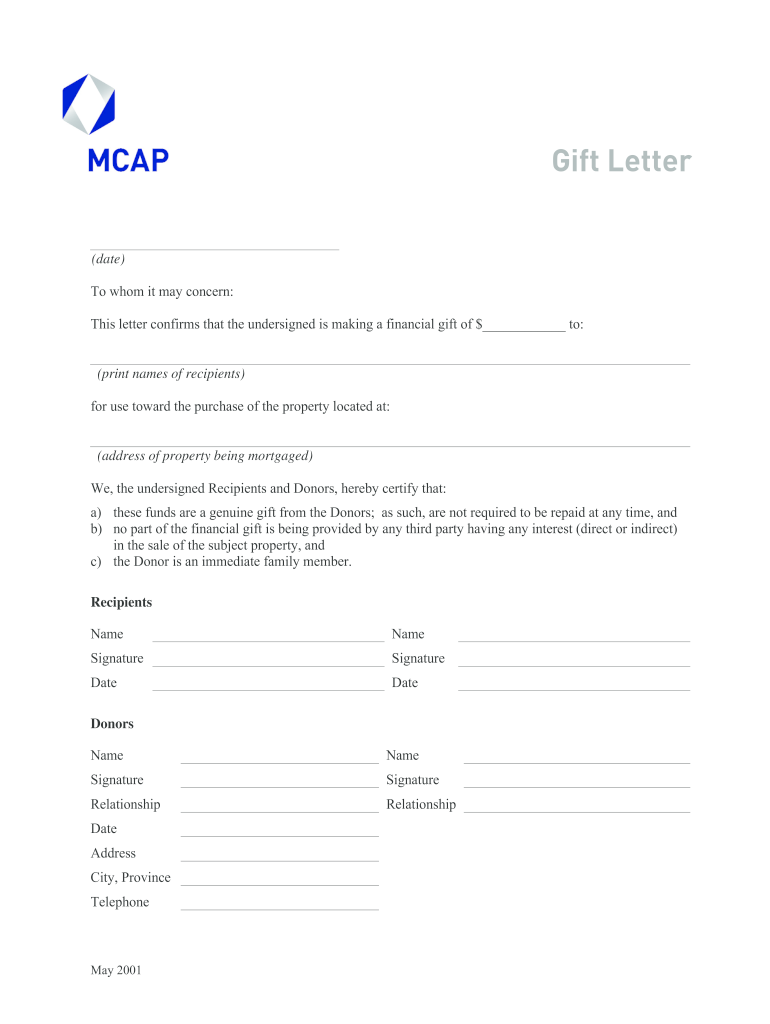

Gift Letter date To whom it may concern This letter confirms that the undersigned is making a financial gift of to print names of recipients for use toward the purchase of the property located at address of property being mortgaged We the undersigned Recipients and Donors hereby certify that a these funds are a genuine gift from the Donors as such are not required to be repaid at any time and b no part of the financial gift is being provided by any third party having any interest direct or...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gift letter for mortgage template form

Edit your gift letter template ontario form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gift letter canada sample form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit down payment gift letter canada online

Use the instructions below to start using our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit gift letter template canada form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out gift letter form

How to fill out Canada MCAP Gift Letter

01

Download the Canada MCAP Gift Letter template.

02

Fill in the date at the top of the letter.

03

Provide the name and address of the person giving the gift.

04

Include the name and address of the recipient of the gift.

05

Specify the amount of the gift in Canadian dollars.

06

State the relationship between the giver and the recipient (e.g., family, friend).

07

Include a statement affirming that the funds are a gift and do not need to be repaid.

08

Sign and date the letter at the bottom.

Who needs Canada MCAP Gift Letter?

01

Individuals applying for a mortgage in Canada who are receiving a financial gift for their down payment.

02

Gift givers who want to provide formal documentation of the gift for financial or legal purposes.

Fill

gift letter template for mortgage

: Try Risk Free

People Also Ask about gift letter for mortgage

How do you write a proof of gift letter?

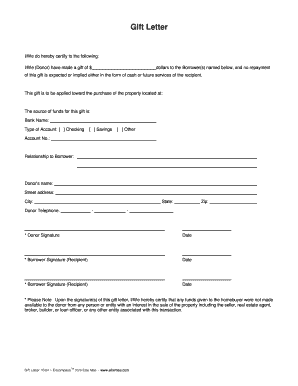

Make sure your gift letter includes the following: The donor's name. The donor's address. The donor's phone number. The donor's relationship to you. The exact dollar amount of the gift. The date the gift was given.

How do you write a gift declaration?

It needs to include: Their name. Your name. The total amount given. A statement that it is a gift. A statement that the gift has no commercial interest. Confirmation that the gift giver has no stake in the property. Confirmation that the gift giver can afford to give you the money.

What is a gift letter for mortgage Canada?

The key component of a gift letter is that it lets the lender know that they money does not need to be paid back and will not form a financial burden on the recipient. It can be considered mortgage fraud if the gifted money is actually a loan since the purpose of the money is misrepresented.

Is a gift letter a legal document?

We can define a gift letter as a legal statement that ensures your bank or lender that the funds that came into your bank account are a gift rather than a loan. Note that a gift letter isn't a promissory note.

What is a gift letter Canada?

If you decide to go forward with gifting money for a down payment, you will need something known as a mortgage gift letter. Generally, the mortgage lender will want to know where the gifted money came from, how much it was, and to confirm that this money is, in fact, a gift with no obligation to be repaid.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my mortgage gift letter directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your sample gift letter to family member pdf and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I complete sample gift letter to family member online?

pdfFiller has made it easy to fill out and sign money gift letter template canada. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I create an eSignature for the family member money gift letter from parents in Gmail?

Create your eSignature using pdfFiller and then eSign your rbc gift letter immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is Canada MCAP Gift Letter?

The Canada MCAP Gift Letter is a document used to verify the source of funds in mortgage applications, specifically for gifts provided by family members to help with a home purchase.

Who is required to file Canada MCAP Gift Letter?

Individuals who receive a monetary gift from family members to assist in purchasing a property are typically required to file the Canada MCAP Gift Letter.

How to fill out Canada MCAP Gift Letter?

To fill out the Canada MCAP Gift Letter, one must provide the donor's name, relationship to the recipient, the amount of the gift, a statement that the funds are a gift and not a loan, and both parties' signatures.

What is the purpose of Canada MCAP Gift Letter?

The purpose of the Canada MCAP Gift Letter is to ensure transparency in the financial transaction and to confirm that the funds provided are indeed a gift and not a financial obligation that needs to be repaid.

What information must be reported on Canada MCAP Gift Letter?

The Canada MCAP Gift Letter must report the donor's information, recipient's information, amount of the gift, the nature of the financial transaction (gift vs loan), and signatures of both the donor and the recipient.

Fill out your Canada MCAP Gift Letter online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gift Letter For Down Payment is not the form you're looking for?Search for another form here.

Keywords relevant to cash gift letter template

Related to financial gift letter template

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.